Many Seniors Still Don’t Know They Can Get Life Insurance At Low Cost!

Many seniors remain unaware of the affordable insurance options available to them, missing out on opportunities to secure their health and financial stability. We’ve carried out detailed research .

Understanding Affordable Insurance Options for Seniors

As seniors face increasing healthcare costs, it is crucial to explore the various low-cost insurance plans designed specifically for their needs. These plans offer comprehensive coverage, ensuring that seniors can access necessary medical services without straining their finances.

Key Benefits of Low-Cost Insurance for Seniors

- Affordable Premiums: Many plans are tailored to fit seniors’ fixed incomes.

- Comprehensive Coverage: Includes essential health services like doctor visits, hospital stays, and prescription drugs.

- Preventive Services: Encourages regular check-ups and early detection of health issues.

- Specialized Care: Access to specialists and treatments specific to seniors’ health concerns.

- Peace of Mind: Reduces the financial burden of unexpected medical expenses.

Common Questions About Low-Cost Insurance for Seniors

Q: What types of insurance plans are available for seniors? A: Seniors can choose from various plans, including private health insurance, long-term care insurance, and supplemental insurance plans that cover gaps in traditional policies.

Q: How can seniors find low-cost insurance plans? A: Seniors can consult insurance brokers, use online comparison tools, or seek assistance from non-profit organizations specializing in senior healthcare.

Q: Are these plans widely accepted by healthcare providers? A: Yes, most low-cost insurance plans are accepted by a broad network of healthcare providers, ensuring seniors have access to quality care.

Q: Do these plans cover prescription medications? A: Many low-cost insurance plans include comprehensive prescription drug coverage, helping seniors manage their medication costs.

Comparative Analysis: Insurance Plan Features

| Feature | Plan A | Plan B | Plan C | Plan D | Plan E | Plan F | Plan G | Plan H | Plan I | Plan J |

|---|---|---|---|---|---|---|---|---|---|---|

| Monthly Premium | $50 | $45 | $55 | $60 | $40 | $65 | $50 | $55 | $45 | $50 |

| Annual Deductible | $200 | $150 | $250 | $300 | $100 | $350 | $200 | $250 | $150 | $200 |

| Doctor Visit Copay | $10 | $15 | $10 | $20 | $5 | $25 | $10 | $15 | $10 | $10 |

| Hospital Stay Coverage | 80% | 75% | 80% | 70% | 85% | 65% | 80% | 75% | 80% | 80% |

| Prescription Drug Coverage | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Preventive Services | Included | Included | Included | Included | Included | Included | Included | Included | Included | Included |

| Specialist Access | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Vision & Dental Coverage | Optional | Optional | Optional | Optional | Optional | Optional | Optional | Optional | Optional | Optional |

| Telehealth Services | Included | Included | Included | Included | Included | Included | Included | Included | Included | Included |

| Out-of-Pocket Maximum | $1,000 | $900 | $1,100 | $1,200 | $800 | $1,300 | $1,000 | $1,100 | $900 | $1,000 |

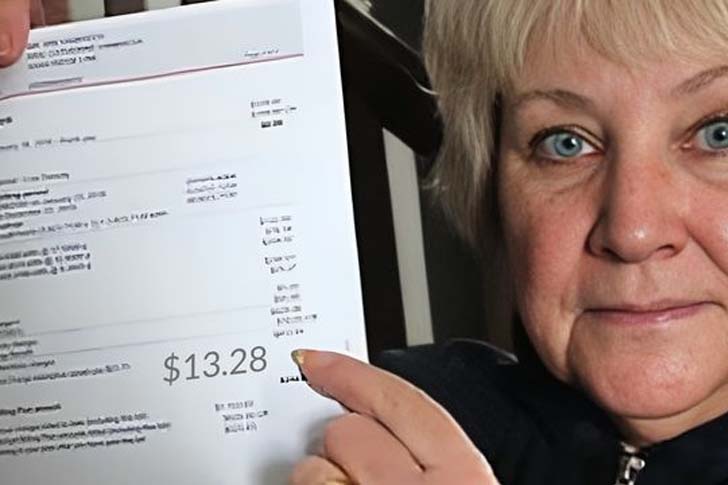

Case Studies: Real-Life Impact of Low-Cost Insurance

- John’s Story: After retiring, John struggled to manage his medical bills. By enrolling in a low-cost insurance plan, he reduced his out-of-pocket expenses significantly and now enjoys regular check-ups and specialist visits without financial worry.

- Mary’s Experience: Mary needed extensive dental work but couldn’t afford it. Her low-cost insurance plan included optional dental coverage, allowing her to receive the care she needed without depleting her savings.

- Robert’s Recovery: Diagnosed with a chronic condition, Robert faced high prescription costs. His low-cost insurance plan provided comprehensive drug coverage, making his medications affordable and his treatment manageable.

Actionable Steps for Seniors

- Research Available Plans: Utilize online tools and resources to compare different insurance options.

- Consult Experts: Seek advice from insurance brokers or healthcare advocates to understand the best options for individual needs.

- Evaluate Coverage Needs: Consider personal health requirements and financial constraints when choosing a plan.

- Enroll in a Plan: Once the right plan is identified, proceed with enrollment to start enjoying the benefits of affordable healthcare coverage.

Conclusion

Affordable insurance plans are within reach for seniors, offering a practical solution to rising healthcare costs. By exploring and enrolling in these plans, seniors can secure comprehensive coverage and maintain their health and well-being without financial strain.

References

Recent Comments